Flagship Product. Our multi-strategy products were first launched in 2009 and have won multiple industry awards.

Global Presence. We have offices in London and Singapore with strong networks within Japan.

Institutional Clients. We serve primarily pensions, financial institutions and endowments.

Team Effort. Diverse group of over 17 professionals across 3 locations led by Founder and CIO Naruhisa Nakagawa (中川 成久), and CEO Nanda Lokanathan.

Philosophy. Caygan (keɪɡʌn / けいがん / 慧眼) is inspired by the Japanese philosophy of deep insight that uncovers the true essence of things. This philosophy guides our processes.

STRATEGIES

We are Multi-Asset Specialists with a Focus on Credit and Macro Themed Opportunities.

Strategy – Our Funds primarily invest in Credit supplemented by Overlays which act as both hedges and independent sources of return. We strive to achieve an optimal portfolio allocation across Credit and Overlays with respect to the credit cycle, economic conditions, and price opportunities.

Instruments – Investments are typically in fixed income, equities, volatility, commodities, interest rates, and all their derivatives.

Research and Risk Management – A multi-disciplinary team of analysts cover global macro, company fundamentals, and quantitative analysis. Our expertise extends to modelling and quantifying the risk inherent in complex financial instruments including Additional Tier 1s, convertible bonds, hybrid credit, and various volatility securities.

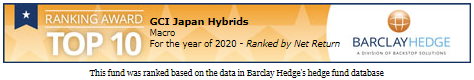

Industry Recognition – Our multi-strategy products have won several performance awards since launch in 2009.

Please contact us at clientrelations@caygan.com if you wish to know more.

We manage tailor made AT1 focused credit portfolios for financial institutions and other corporate investors.

We draw on our expertise in credit markets and quantitative risk management, to customize a credit portfolio that suits our client’s yield and risk appetite.

Please contact us at clientrelations@caygan.com if you wish to know more.

Participate in the Investment Potential of Carbon Credit Markets

Strategy – Our Fund intends to achieve capital appreciation over the long term through application of strategies including, Buy & Hold (primary strategy), Tactical Rotation, Relative Value/Arbitrage, and Risk Hedge. It intends to invest in both the voluntary, and compliance carbon markets.

Instruments – Investments are in spot and futures instruments within both the voluntary and compliance carbon credit markets.

Research and Risk Management – A multi-disciplinary team of analysts cover global macro, company fundamentals, and quantitative analysis. Our expertise extends to modelling the pricing and risk relationships between voluntary offsets and their underlying features, between spot, forward and futures instruments, and between securities within voluntary and compliance markets.

Please contact us at clientrelations@caygan.com if you wish to know more.

In recent years, our research has extended into private firms attempting to tackle problems around sustainability and ageing societies through innovative and high growth solutions. Despite the influx of capital to private companies, we believe there remains a funding gap for early stage companies in this category. We look to plug this gap at attractive valuations.

Investment Highlights

Please contact us at clientrelations@caygan.com if you wish to know more.

LEADERSHIP

Naruhisa Nakagawa

Naruhisa is the Founder and CIO of Caygan. He joined GCI Asset Management in 2009 to develop his multi-strategy funds and later initiated a spin-off to establish Caygan Capital. Prior to GCI, Naruhisa was a Director in Merrill Lynch Japan where he traded equity, fixed income (including convertible bonds) and related derivatives. Previously, he was with Goldman Sachs Japan where he traded convertibles and credit derivatives, while also focusing on model development.

Naruhisa graduated from the University of Tokyo and was awarded the Ouchi Hyoei Prize (Memorial Prize) and best senior thesis for his paper on Convertible Pricing with Credit Risk. He also co-authored a paper on Pricing Convertible Bonds with Default Risk which was published in the journal of Fixed Income in December 2001 and subsequently obtained >100 citations.

Nanda Lokanathan

Nanda is the CEO of Caygan Singapore. He joined GCI Singapore (now Caygan) in 2007 and has performed diversified roles such as trader for multiple strategies and asset classes, FoHF analyst, head of operations and compliance, head of risk, and Chief Operating Officer. Presently, Nanda oversees the overall firm operations, including trading and risk activities. Nanda began his career with Citi focusing on alternative investments.

Nanda graduated from the National University of Singapore with a B.Sc. in Computer Science and pursued his Minor in Technology Entrepreneurship at the University of Pennsylvania. In addition, he holds a M.Sc. in Applied Economics from the Singapore Management University and a L.L.M in Corporate Finance Law from the University of London.

Naruhisa Nakagawa

Naruhisa is the Founder and CIO of Caygan. He joined GCI Asset Management in 2009 to develop his multi-strategy funds and later initiated a spin-off to establish Caygan Capital. Prior to GCI, Naruhisa was a Director in Merrill Lynch Japan where he traded equity, fixed income (including convertible bonds) and related derivatives. Previously, he was with Goldman Sachs Japan where he traded convertibles and credit derivatives, while also focusing on model development.

Naruhisa graduated from the University of Tokyo and was awarded the Ouchi Hyoei Prize (Memorial Prize) and best senior thesis for his paper on Convertible Pricing with Credit Risk. He also co-authored a paper on Pricing Convertible Bonds with Default Risk which was published in the journal of Fixed Income in December 2001 and subsequently obtained >100 citations.

______________________________

Nanda Lokanathan

Nanda is the CEO of Caygan Singapore. He joined GCI Singapore (now Caygan) in 2007 and has performed diversified roles such as trader for multiple strategies and asset classes, FOHF analyst, head of operations and compliance, head of risk, and Chief Operating Officer. Presently, Nanda oversees the overall firm operations, including trading and risk activities. Nanda began his career with Citi focusing on alternative investments.

Nanda graduated from the National University of Singapore with a B.Sc. in Computer Science and pursued his Minor in Technology Entrepreneurship at the University of Pennsylvania. In addition, he holds a M.Sc. in Applied Economics from the Singapore Management University and a L.L.M in Corporate Finance Law from the University of London.

SUSTAINABILITY

As an investment firm, we acknowledge our duty to both operate and make investment decisions in a responsible manner, with due consideration to environmental and social concerns. Caygan is a signatory to the United Nations-supported Principles for Responsible Investment (PRI) and we are committed to the PRI’s six principles.

Responsible Investing. Our investment activities are subject to our Responsible Investment Policy (RIP), which has been drafted taking into consideration United Nations initiatives and other recommended practices. Please contact us at clientrelations@caygan.com if you wish to know more.

Supporting Startup Initiatives. We have channelled our profits from Caygan to private companies tackling climate change and key social problems. We set the tone from the top.

PARTNERS

GCI Asset Management (GCI AM) is a Tokyo based investment firm providing alternative investment solutions for primarily institutional investors. Established in 2000, it focuses on developing innovative strategies that exhibit low correlation to traditional asset classes. Today, it has over 40 employees, managing assets over two billion dollars across multiple strategies.

Caygan’s Singapore office (formerly known as GCI IMS) was first established in 2004 by GCI AM. GCI IMS was re-branded as Caygan following the takeover by our CIO – Naruhisa Nakagawa. Presently, GCI AM remains a minority shareholder and a business partner of Caygan.

CAYGAN CAPITAL PTE. LTD.

A CMS License holder granted by the

Monetary Authority of Singapore

600 North Bridge Road, #09-10,

Parkview Square, Singapore, 188778

CAYGAN CAPITAL LTD.

Authorised and regulated by the

Financial Conduct Authority

4th Floor, 6 Lloyds Avenue,

London EC3N 3AX

CAYGAN CAPITAL PTE. LTD.

A CMS License holder granted by the

Monetary Authority of Singapore

600 North Bridge Road, #09-10,

Parkview Square, Singapore, 188778

CAYGAN CAPITAL LTD.

Authorised and regulated by the

Financial Conduct Authority

4th Floor, 6 Lloyds Avenue,

London EC3N 3AX